“WITH YOU AND FOR YOU, CHANGING ORPEA!” THE REFOUNDATION PLAN

SIMULTANEOUS OPENING OF DISCUSSIONS WITH THE HOLDERS OF ORPEA SA’S UNSECURED DEBT, WITH A VIEW TO RESTORING THE FINANCIAL BALANCE

- The Group’s ambition: to recover its status as the leading player in the sector by refocusing on the quality of care and support and the development of its employees

- In order to achieve this, ORPEA has to CHANGE!

- Change the method: “With You and For You” to involve all its stakeholders in reshaping the Group;

- Change the approach to care and support with continuous improvement in medical and ethical practices and in the safety and well-being of employees;

- Rebalancing the financing strategy:

- Improve operational performance: 9% annual revenue growth by 2025, EBITDAR margin above 20% in 20251, for an estimated EBITDA excluding IFRS 16 of €745m (12.2%) in 2025 2 ;

- Redefine our property holding strategy (with the potential to dispose of assets as soon as conditions allow) and our geographical scope (restructuring or disposing of countries where the Group does not have an attractive position);

- Restoring a sustainable financial structure.

PUTEAUX, France–(BUSINESS WIRE)–Regulatory News:

Laurent Guillot, ORPEA’s (Paris:ORP) Chief Executive Officer since 1 July, today presents the plan: “CHANGING ORPEA! WITH YOU AND FOR YOU”, a plan to rebuild trust and involve its stakeholders: “Four months after my arrival, my diagnosis is clear: ORPEA has moved away from its core activity, focusing on international and real estate development too quickly, at the cost of excessive debt and a very fragile financial situation. In addition, the Group suffered from completely dysfunctional management practices and embezzlement by the former management team.

Faced with this unprecedented situation, with the new management and the unanimous support of the Faced with this unprecedented situation, I am proud to present, with the new management, an ambitious plan for reorganizations in the service of our main mission: to care for the most fragile people.

Today, November 15, we are starting our transformation, which is necessary for residents, patients and their families, employees and society.

We want to give our employees the means and conditions to accomplish the mission that motivates them all: to take care of our patients and residents. To do this, we must build the foundations of renewed trust with all our stakeholders: families, the authorities, the financial markets and shareholders. We will:

- Take care of those who provide care, and give them the desire and the means to do their jobs better and better by redesigning a human resources policy that is equal to the challenges;

- Aim relentlessly for excellence in care and support with a new Medical Director;

- To have a positive social and economic impact, with strong local roots;

- Rebuild a transparent and efficient business model.

In a context that has deteriorated significantly, we must also put in place a new, adapted and sustainable financial structure. This is the essential condition for ORPEA to succeed in its re-foundation and to face the future with serenity.

We have solid assets to accomplish this reorganization in a growing sector. Our plan “ORPEA CHANGE! WITH YOU AND FOR YOU” sets a target of 9% annual growth in revenue by 2025 on a like-for-like basis, an EBITDAR margin of over 20% by 2025, and a target of holding 20 to 25% of our real estate assets.

In countries where the Group considers that it does not have a sufficiently attractive position, ORPEA will consider restructuring or exit operations.

With a highly committed and motivated management team, and the expertise and support of our 72,000 employees, I am confident in the implementation of our transformation. Together we will successfully reshape ORPEA.”

■ Concrete and rapid actions undertaken from July

Actions were immediately initiated, particularly in France. They were articulated around 3 objectives: Remedy, Organize, Remobilize.

Remedying: getting the company “back on track”. This means zero tolerance for unethical practices, transparent review when an institution is challenged, a revised policy for reporting Serious Adverse Events (SAEs), increased attention to recruitment and retention of staff, and a strengthened training system on ethics and good treatment.

Organizing: bring the Group up to the best standards in the sector, structure a Human Resources and salary policy, create an Ethical Care and Benevolence Committee in France, launch the reorganizations of support functions.

Remobilizing: regaining our position as a major player in tomorrow’s “ageing well” means broadening the dialogue with stakeholders (begun with the Etats Généraux), defining a raison d’être, engaging in a reflection on the company’s mission (mission-driven status), inventing tomorrow’s care and services, while promoting synergies between our businesses

■ A broader reflection to respond to the challenges of our businesses, to the situation of the Group and to initiate the plan for the re-foundation of ORPEA

In all our markets, the growth in needs and the increased complexity of care is a major challenge. Between 2021 and 2030, the European population aged over 75 will increase from 66 to 81 million people and the average age of entry into long-term care facilities will rise from 87 to 90, which means that care will be more complex. The need for mental health care is also increasing, with, for example, the prevalence of depressive syndromes rising from 7% to 13% between 2014 and 2021 according to DREES (Direction de la Recherche, des Etudes, des Evaluations, et des Statistiques). At the same time, the expectations of patients, residents and their families are changing: today’s “boomers” are attached to their autonomy and social life; generation X will be particularly attached to transparency and their rights. In mental health, the Group also takes care of young people with still different expectations.

Faced with these needs, the difficulties in recruiting care staff are increasing and the view of staff on their profession is ambivalent: while pride in their profession remains very high, at over 90%, the conditions and fatigue associated with the work are mostly judged negatively. To meet these challenges, the Group has solid assets that allow it to be confident for the future:

- 72,000 employees worldwide are committed and proud of their mission;

- Proven care protocols;

- More than 1,000 facilities, diversified in their activities and locations.

■ In view of these observations and the Group’s situation, the ambition is clear

ORPEA must once again become the benchmark player in the sector and to do this it must reinvent itself. It must provide its employees with the means and conditions to accomplish the mission that motivates them all: caring for patients and residents. To do this, we must build the foundations of renewed trust with all stakeholders: families, authorities and financial markets.

■ ORPEA launches the Plan WITH YOU AND FOR YOU, CHANGING ORPEA!

- Priority 1 – With employees, especially caregivers

We must take care of those who provide care and give them the desire and the means to do their job well. Fanny Barbier, the new Group Human Resources Director, has set herself the following objectives:

- To create, together with the employees, the conditions to guarantee their health, safety and well-being at work. In terms of objectives, the Group is aiming for a 20% reduction in work-related accidents by 2025;

- Re-design the salary and social policy by fully integrating the social partners;

- To succeed in retaining employees in order to reduce turnover and temporary contracts by investing in continuous training and internal promotion;

- Engage by 2024, all “acting” staff in an active training process leading to qualifications;

- Anticipate the need for resources by increasing the number of apprenticeship contracts fivefold, i.e. from 200 to 1,000 contracts by 2024 in France;

- Restore more autonomy and initiative to school directors, with the reduction of administrative tasks and a local Human Resources function;

- Aligning incentives from top management to facility managers on the basis of a new balance: Safety / Health – Quality – Performance;

- Breaking down silos and providing transparency to establishments to compare their performance and, more broadly, making ORPEA a collaborative and learning company.

- Priority 2 – With patients and residents

In order to meet the new expectations and to develop together the answers to the care and support challenges of tomorrow, Professor Pierre Krolak-Salmon, the Group’s new Medical Director, will have the following main tasks:

- To set up a medical project, relying on three key pillars. The facilities’ Medical Commissions, keystone of the system. Scientific council in charge of spreading and implementing state-of-the-art medical and care. And a Ethics Steering Committee, chaired by Emmanuel Hirsch, that will provide concrete and operational responses to our colleagues, patients, residents, families and all of our stakeholders;

- To guarantee the best quality and safety of care at all times with reviewed KPI and Develop a benevolent, non-stigmatising and learning quality culture;

- To promote innovations that benefit patients, residents, families and professionals;

- Playing our part fully in all aspects of care, and in particular providing excellent accommodation with local and enjoyable catering, and offering personalized activities;

- Nurture a more fluid communication between our teams, our patients and residents and their families;

- Personalizing the support of our patients and residents by working on local care and life paths across the Group activities and services offered.

- Priority 3 – with Society as a whole

The Group must have a positive economic and social impact, which means:

- Enhance the ethics and good treatment training system by training over 300 people by the end of 2024;

- Increase employee awareness of the declaration of conflicts of interest;

- Train 100% of the workforce in France by the end of 2023, i.e. a total of 26,000 employees, in the new Code of Ethical Conduct and Corporate Social Responsibility;

- Strengthen local roots: with local communities (associations, universities, etc.) and with local healthcare providers.

- In terms of environmental objectives, the Group aims to: reduce carbon emissions, in kg of Co² per m² per year, by -17% by 2025 and -32% by 2030; reduce water consumption; recover 70% of waste from our construction sites; implement certification for 100% of new buildings.

■ Priority 4 – With our various partners

In this respect, the proper management of the real estate portfolio is an essential point. Géry Robert-Ambroix, the Group’s new Real Estate Director, will have the main task of putting real estate in its rightful place: a business line serving operations. The medium-term objective is to hold a limited number of proprietary assets (20 to 25% of the portfolio), compared with 47% at the end of 2021.

■ The Group has identified a portfolio of real estate assets estimated at more than €1 billion, ready to be sold as soon as market conditions allow;

■ In the medium term, creation of a real estate company dedicated to ORPEA, in which the Group would remain the main shareholder and operator. This structure would allow the capital to be opened up to long-term investors.

The Group’s future real estate development will be based on very selective criteria, focusing on markets where the Group has a leading position, aiming for a double-digit operating EBITDA margin and a development margin close to 10%.

Laurent Lemaire, the Group’s Chief Financial Officer, has begun reorganising the support functions to provide the necessary support to the facilities. Three key projects are underway: an IT upgrade, the structuring of a purchasing function and simplified financial and administrative management. Business monitoring tools are also being deployed for both the financial and non-financial aspects.

At the same time, the Group has launched a strategic review of its portfolio to focus on the most attractive countries and identify restructuring or disposal plans if necessary.

■ Financial implications of the plan

The Group aims for a gradual turnaround in performance over the period 2022-2025, with:

- An average increase in the number of facilities of 4% per year, to reach 1,173 sites, and in the number of beds of 3.3% per year, to reach 96,806 beds in 2025;

- An average growth in turnover of 9% per year, to reach 6.1 billion Euros in 2025;

- EBITDAR margin growth of 340 basis points to 20.4%. This represents an average increase of 16% over the period and an EBITDAR of EUR 1.25 billion in 2025;

- An EBITDA margin excluding IFRS 16 of 12.2%, i.e. an EBITDA excluding IFRS 16 of EUR 745 million in 2025, up 28% over the period 2022-2025.

The evolution of the main financial aggregates is detailed in the table below:

| In €m | 2021A | 2022E | 2023E | 2024E | 2025E |

| Revenue | 4,299 | 4,688 | 5,326 | 5,737 | 6,102 |

| EBITDAR | 1,070 | 797 | 911 | 1,083 | 1,246 |

| % EBITDAR | 25% | 17% | 17% | 19% | 20% |

| EBITDA excl. IFRS 16 | 682 | 358 | 433 | 593 | 745 |

| % EBITDAR excl. IFRS 16 | 16% | 8% | 8% | 10% | 12% |

The increase in EBITDAR represents an improvement of approximately €450 million over the period 2022-2025.

The increase in margin is mainly due to the implementation of the WITH YOU AND FOR YOU, CHANGING ORPEA! Plan. For example, the structuring of a Human Resources function will make it possible to reopen beds that are currently closed due to a lack of staff or to bring temporary staff in-house. The plan also includes a section dedicated to patients, residents and their families. It will enable a return to the pre-COVID occupancy rate. The work carried out on the structuring of support functions and in particular the purchasing function will contribute to increasing the margin rate.

The opening of new establishments and the restructuring of existing establishments represents more than 35% of the growth in EBITDAR over the period. In this respect, the new management has already made a selection of the Group’s development projects in order to keep only the most profitable ones.

For the period 2022-2025, the Group has an investment plan totaling €2.5 billion. This plan is the essential support for the strategic vision to rebuild the Group. 63% will be devoted to the renovation and extension of the existing facilities and to the construction of new ones. €1.6 billion, of which 78%, already committed, will be spent over 2022-2023. In 2024-2025, the budget will be greatly reduced. 37% will be spent on IT and maintenance. €230 million per year on our existing portfolio. €368 million over the period 2022-2025 for IT alone, an investment necessary to support the implementation of the plan.

In conclusion, Laurent Guillot added: “We have been building this new foundation since the Etats Généraux du Grand Age and in a collaborative manner. We owe it to our patients and residents, as well as to their families. We owe it to our employees. We owe it to the territories where we are present, and to the communities that live there. And we owe it to our investors. We owe it to them, because we are in an essential business: we care for and support the most vulnerable. WITH YOU AND FOR YOU, CHANGING ORPEA: it’s now! »

Financial Objectives, liquidity update and update on the Group’s restructuring process

Financial Objectives

The information regarding the Group’s 2023, 2024 and 2025 financial objectives and estimated financial information for the financial year ending 31 December 2022 are set out in annex 1.

Liquidity update

Since the publication of its Q3 2022 revenue on 8 November 2022, the Group has finalised the review of its short-term liquidity forecast. As of 2 November 2022, the Group is exposed to a risk of liquidity shortfall during the course of Q1 2023.

All the information on the liquidity situation of the Group, in the short term and in the medium term, is included in annex 1.

Update on the Group’s restructuring process

In accordance with the announcements made in the press release dated 26 October 2022, the Group is committed to launching a drastic financial restructuring to achieve a sustainable financial structure. ORPEA confirms that the following elements are being considered, among others:

- An equity conversion of ORPEA S.A.’s unsecured debt, amounting to €3,8 million, by way of a rights issue opened to existing shareholders and backstopped by unsecured lenders;

- 1.9-2.1 billion of new money, in the form of (a) new secured debt on assets of the group for a target amount of €600 million (in order to cover ORPEA S.A.’s funding needs until early summer) and (b) a second share capital increase.

ORPEA S.A. expects that pro forma these equity transactions, at least 20% of its share capital will be held by long-term French institutional investors.

It is important to highlight that the implementation of these transactions would result in a massive dilution for existing shareholders who would decide not to participate.

The objective of the Conciliation process that has been initiated is to find a solution to the capital structure and attract new capital to fund ORPEA’s business plan and cover the risk of a liquidity shortfall as detailed in annex 1 hereto. While the Group has not concluded on the implementation mechanism, this could entail, inter alia, an accelerated safeguard to facilitate closure of the process in the event that unanimity cannot be obtained.

If the company is not able to successfully find a solution in the context of the conciliation, ORPEA will not be able to implement its transformation plan.

More information about the Group’s restructuring process is set out in annex 1 hereto.

About ORPEA

ORPEA is a leading global player, expert in the care of all types of frailty. The Group operates in 22 countries and covers three core businesses: care for the elderly (nursing homes, assisted living, home care), post-acute and rehabilitation care and mental health care (specialized clinics). It has more than 72,000 employees and welcomes more than 255,000 patients and residents each year.

ORPEA is listed on Euronext Paris (ISIN: FR0000184798) and is a member of the SBF 120, STOXX 600 Europe, MSCI Small Cap Europe and CAC Mid 60 indices.

ORPEA ANNOUNCES ITS FINANCIAL OBJECTIVES AND PROVIDE AN UPDATE ON ITS LIQUIDITY POSITION AND PROPOSED RESTRUCTURING

Puteaux (France), 15 November 2022 (7:45 am CET)

1. Financial Objectives

Main assumptions

The build-up of the Group’s plan and the financial objectives and estimated financial information set out below are based on the following main assumptions:

- A recovery in the occupancy rates and new revenue management policies;

- A ramp-up of the greenfield contribution over time given significant investment over the period;

- A relative stability in the fixed cost base, following strong recruitments and inflationary impacts in 2022 and 2023, allowing the Group to fully benefit from the recovery of its occupancy rates over time and in particular in 2025.

A more disciplined approach to development projects, recognising that significant initiatives have been undertaken to halt or reduce the capex commitments previously initiated, but there are still ongoing commitments that require funding until completion.

In parallel, the Group is constantly identifying, monitoring and updating its pipeline of potential real estate asset sales depending on market conditions and the Group’s ability to execute sizeable sale & lease-back while undertaking in the meantime a comprehensive financial restructuring. The Group contemplates, in the long term, to own 20-25% of its real estate portfolio and will seek to establish in the mid-term, a new real estate investment vehicle to increase monetisation alternatives at that entity level (e.g., equity offering to long-term investors).

Main financial objectives

Financial objectives for 2023, 2024 and 2025

Revenue expected to increase from €5.3 billion in 2023, to €5.7 billion in 2024 and €6.1 billion in 2025 vs. €4.3 billion in 2021A and €4.7 billion in 2022. The contemplated 9.2% 2022-2025 CAGR revenue expansion driven by:

- occupancy recovery post covid 19 crisis,

- price increases in line with costs inflation, supported by new revenue management policies, and

- significant developments already engaged in France, Benelux, Iberian Peninsula, and Latam as 120 new facilities (net of closing) are expected to open and total number of installed beds3 from 93k in 2023 to 97k in 2025.

- Group EBITDAR expected to increase from €0.9 billion in 2023 to €1.1 billion in 2024 and €1.25 billion in 2025 (vs. €1.1 billion in 2021A and €0.8 billion in 2022), mainly through:

- revenue increase, driven by the factors described in the above paragraph,

- improved margin as a result of a relative stability in the fixed costs base as (a) personnel costs4 and food and energy expenses5, as a % of revenue are projected to normalise over time, and (b) HQ costs, as a % of revenue, are expected to reduce from 6.8% in 2022 to 5.8% in 2025, as investments will start yielding a significant payback.

- positive impact of the ramp up of greenfield projects in 2024 and 2025.

From 2022-2025, approximately 50% of EBITDAR growth will be generated from France, which together with Germany, Switzerland and Austria will represent in aggregate c. 75% of Group’s EBITDAR in 2025.

- Group EBITDA pre IFRS 16 (after external real estate rental charges) expected to increase from €0.4 billion in 2023 to €0.6 billion in 2024 and €0.75 billion in 2025 vs. €0.7 billion in 2021A and €0.4 billion 2022E, mainly driven by the factors described above regarding EBITDAR.

- Group operating cash-flows6 expected to increase from €132 million generated in 2023 to €295 million in 2024 and €471 million in 2025 vs. €59 million in 2022. For the avoidance of doubt, the Group operating cash flows take into account €0.7 billion in cumulative maintenance and IT CAPEX mentioned below.

The Group also plans to finance €0.9 billion in development CAPEX over the period 2023-2025 (including €0.5 billion for the year 2023 alone), in addition to €0.7 billion cumulative in maintenance and IT CAPEX (as some of the IT CAPEX spend relate to necessary technological catch-up CAPEX).

Estimated financial information for the financial year ending 31 December 2022

The current adverse evolution of the Group’s operating environment and the high level of uncertainty resulting therefrom (in particular with regards to volatility in energy costs and potentially lower than expected recovery on the occupancy rates due to the adverse backdrop relating to the financial restructuring) could affect the Group’s visibility on its performance, which could be lower than expected.

In this context, for the current financial year ending 31 December 2022, the Group expects:

- Revenue to be around €4.7 billion (vs €4.3 billion in 2021);

- EBITDAR to be around €0.8 billion (i.e. an EBITDAR margin of c. 17%) (vs €1.1 billion in 2021, i.e. an EBITDAR margin of 25%); EBITDA pre IFRS 16 to be around €0.35 billion (vs €0.7 billion in 2021);

- Operating cash-flows to be around €59 million;

- Cash Balance expected to be around €350 million by year-end.

The Group therefore expects its profitability to deteriorate for the financial year ending 31 December 2022, mainly due to a highly inflationary environment, lower-than-expected occupancy rates in the crisis context (reputational impacts) and post-covid 19 subsidies decrease.

2. Liquidity and Debt Update

Debt structure and contractual repayment structure

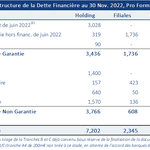

The debt structure of the Group as of 30 November 2022, taking into account drawings on Tranches B and C already agreed (subject to finalization of documentation) would be as attached.

The debt principal schedule of the Group from 1 December 2022, taking into account drawings on Tranches B and C already agreed (subject to finalization of documentation) is as attached.

Contacts

Investor Relations

ORPEA

Benoit Lesieur

Investor Relations Director

[email protected]

Investor Relations

NewCap

Dusan Oresansky

Tel.: +33 (0)1 44 71 94 94

[email protected]

Media Relations

ORPEA

Isabelle Herrier-Naufle

Media Relations Director

Tel.: +33 (0)7 70 29 53 74

[email protected]

Image 7

Charlotte Le Barbier

Tel.: +33 (0)6 78 37 27 60

[email protected]

Toll free tel. nb for shareholders:

+33 (0) 805 480 480