UBS: 1Q21 Net Profit of USD 1.8bn, 18.2% Return on CET1 Capital

Group highlights

- Building on client connectivity through advice, solutions and thought leadership in a dynamic environment: Our clients continued to put their trust in us and benefitted from the full spectrum of our business mix and geographical diversification. This, together with favorable market conditions and investor sentiment, led to higher recurring revenues YoY, while strong client activity drove transaction income, as well as an increase in lending across our businesses.

- 1Q21 financials: PBT was USD 2,298m (up 14% YoY), including net credit loss releases of USD 28m. The cost/income ratio was 73.8%, 1.5 percentage points higher YoY. Operating income increased by 10% YoY, while operating expenses increased by 8%. Net profit attributable to shareholders was USD 1,824m (up 14% YoY), with diluted earnings per share of USD 0.49. Return on CET1 capital1 was 18.2%. The default by a US-based client of our prime brokerage business resulted in an impact on net profit attributable to shareholders of USD 434m.

- Our strong capital position supports growth and shareholder returns: The quarter-end CET1 capital ratio was 14.0% (guidance: ~13%) and the CET1 leverage ratio was 3.89% (guidance: >3.7%), both up QoQ. We paid the 2020 ordinary dividend of USD 0.37 per share in April 2021 (USD 1.3bn) and we repurchased USD 1.1bn of shares year-to-date. We will resume repurchasing shares shortly.

- Unlocking the power of UBS: We have unveiled our purpose statement: Reimagining the power of investing. Connecting people for a better world. Our purpose – together with our new strategic framework consisting of our vision, client promise, strategic imperatives, and sustainability commitments – maps out the next steps in our firm’s journey.

UBS’s 1Q21 results materials are available at ubs.com/investors

The audio webcast of the earnings call starts at 09:00 CET, 27 April 2021

ZURICH & BASEL, Switzerland–(BUSINESS WIRE)–Regulatory News:

UBS (NYSE:UBS) (SWX:UBSN):

Ralph Hamers, UBS’s CEO said:

“In the first quarter of 2021, our clients benefited from our broad capabilities, geographic reach and connectivity. They continued to put their trust in us and looked to UBS for advice, solutions and thought leadership in a dynamic market environment. This was evidenced by the continued net inflows that helped our invested assets across wealth and asset management grow by over 100 billion dollars to 4.2 trillion. This, together with favorable market conditions and improved investor sentiment, contributed to positive results in the first quarter of 2021. All in all, we saw record activity across our client franchises, resulting in operating income being up 10%, profit before tax up 14%, and net profit attributable to shareholders up 14%, compared with the first quarter of 2020 which was strong in itself.

However, our first quarter results also factored in a loss related to the default by a single US-based prime brokerage client. We are all clearly disappointed and are taking this very seriously. A detailed review of our relevant risk management processes is underway and appropriate measures are being put in place to avoid such situations in the future. This never impeded our ability to serve our clients. We were still able to increase our CET1 capital ratio to 14% and deliver a return on CET1 capital of 18%. Our Investment Bank fully absorbed this loss, yet still delivered a 13% return on attributed equity, which would have been in excess of 30% had it not been for this incident.

Our financial strength and ability to weather all seasons, together with our unique positioning as the largest truly global wealth manager, enable us to look to our future with confidence. In an ever-evolving world, we, too, must continue to improve and adapt. That’s why I’m proud to unveil our new strategy today. It all starts with our purpose, our why: Reimagining the power of investing. Connecting people for a better world.

Our purpose and strategy – underpinned by a newly defined vision, our client promise, and five strategic imperatives – outline the actions we’re taking to unlock the power of UBS and evolve into a more client-focused, more agile, more digital firm. A firm that puts a personalized, relevant, on-time and seamless client experience and sustainability at the center of everything we do.”

1Q21 financial performance – selected highlights

| Group |

|

| |||||

| Return on CET1 capital | 18.2% | Target: 12–15% | |||||

| Return on tangible equity | 14.0% |

| |||||

| Cost/income ratio | 73.8% | Target: 75–78% | |||||

| Net profit attributable to shareholders | USD 1.8bn |

| |||||

| CET1 capital ratio | 14.0% | Guidance: ~13% | |||||

| CET1 leverage ratio | 3.89% | Guidance: >3.7% | |||||

| Tangible book value per share | USD 14.65 |

| |||||

|

|

|

| |||||

| Global Wealth Management |

|

| |||||

| Profit before tax | USD 1.4bn |

| |||||

| PBT growth | 16% | Target: 10–15% over the cycle | |||||

| Invested assets | USD 3.1trn |

| |||||

| Net new fee-generating assets | USD 36bn |

| |||||

|

|

|

| |||||

| Personal & Corporate Banking |

|

| |||||

| Profit before tax | CHF 0.4bn |

| |||||

| Return on attributed equity (CHF) | 17% |

| |||||

| Net new business volume growth for Personal Banking (CHF) | 7.6% |

| |||||

|

|

|

| |||||

| Asset Management |

|

| |||||

| Profit before tax | USD 0.2bn |

| |||||

| Invested assets | USD 1.1trn |

| |||||

| Net new money | USD 26bn |

| |||||

|

|

|

| |||||

| Investment Bank |

|

| |||||

| Profit before tax | USD 0.4bn |

| |||||

| Return on attributed equity | 13% |

| |||||

| RWA and LRD vs. Group | 33% / 32% | Guidance: up to 1/3 |

Outlook

Investor sentiment remained positive in the first quarter of 2021, helped by the strong rebound in economic activity and greater optimism regarding the further recovery, supported by mass COVID-19 vaccination campaigns around the globe. Significant fiscal stimulus, notably in the US, along with the prospect of continued accommodative monetary policy, contributed to generally more positive views on the timing and extent of a sustainable economic recovery.

However, economic, social, and geopolitical tensions remain, raising questions around the sustainability and shape of the recovery. Persistently high numbers of COVID-19 infections and hospitalizations, as well as lockdowns and similar measures imposed to control the pandemic, add to these existing concerns, as well as the severity and duration of the effects of the pandemic in certain economic sectors.

Our clients value strength and expert guidance, particularly in these uncertain times, and we remain focused on supporting them with advice and solutions. We expect our revenues in the second quarter of 2021 to be influenced by seasonal factors, such as lower client activity compared with the first quarter of 2021. Higher asset prices should have a positive effect on recurring fee income in our asset gathering businesses. However, the continued uncertainty about the environment and economic recovery could affect both asset prices and client activity.

With our balance sheet for all seasons and our diversified business model, UBS remains well positioned to drive sustainable long-term value for our clients and shareholders.

First quarter 2021 performance overview

Group PBT USD 2,298m, +14% YoY

Group PBT was USD 2,298m (up 14% YoY), including net credit loss releases of USD 28m. The cost/income ratio was 73.8%, 1.5 percentage points higher YoY, as income (before credit loss expense) increased by 6% and total operating expenses increased by 8%. Operating income increased by 10% YoY. Net profit attributable to shareholders was USD 1,824m (up 14% YoY), with diluted earnings per share of USD 0.49. Return on CET1 capital1 was 18.2%.

The default by a US-based client of our prime brokerage business resulted in an impact on 1Q21 Group net profit of USD 434m. The related loss in operating income of USD 774m was recognized within the Financing business in the Investment Bank, which provided prime brokerage services to the client, and arose as a result of closing out a significant portfolio of swaps with the client following the default and the unwinding of related hedges. We have exited all remaining exposures in April 2021, with related losses recognized in the second quarter of 2021 which are immaterial for the Group.

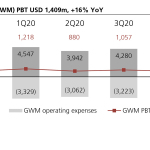

Global Wealth Management (GWM) PBT USD 1,409m, +16% YoY

GWM delivered PBT growth in all regions. Recurring net fee income increased 8%, mainly driven by higher average fee-generating assets. Transaction-based income rose 6% on continued high levels of client activity in a constructive market environment. Net interest income decreased by 3%, due to the ongoing pressure from lower US dollar interest rates on deposits, and despite higher revenues from lending. Net credit loss releases were USD 3m. The cost/income ratio improved to 71.0%, down 1.4 percentage points YoY, as income increased by 5% and operating expenses increased by 3%. Loans increased to USD 219bn, with over USD 10bn of net new loans. Invested assets increased 3% sequentially to USD 3,108bn. Fee-generating assets2 rose to USD 1,328bn, up 4% sequentially. Net new fee-generating assets2 were USD 36.2bn, supported by inflows in all regions.

Personal & Corporate Banking (P&C) PBT CHF 358m, +11% YoY

Operating income increased 9%, mainly on credit loss releases of CHF 22m as compared with credit loss expenses in the prior year, as well as a valuation gain of CHF 26m related to the SIX Group and 7% higher recurring net fee income. Lower revenue from credit card and foreign exchange transactions was the main driver of a decrease in transaction-based income, reflecting the effects of the COVID-19 pandemic on travel and leisure spending by clients. Lower deposit revenues mainly drove the 5% decrease in net interest income, reflecting a decrease in margins mainly as a result of lower US dollar interest rates. The cost/income ratio was 63.8%, an increase of 5.8 percentage points YoY, as income decreased by 2% and operating expenses increased by 8%, reflecting higher investments in technology and real estate expenses due to the closure of 44 branches in the first quarter of 2021. Net new business volume growth for Personal Banking was 7.6%.

Asset Management (AM) PBT USD 227m, +45% YoY

Operating income increased by 24% YoY with 153% higher performance fees, while net management fees rose 14%. Performance fees increased, mainly in our Hedge Fund Businesses, partly offset by our Equities business. The cost/income ratio was 64.4%, a 5.1 percentage point improvement YoY, with 24% income growth and 15% higher operating expenses. Invested assets increased 3% QoQ to USD 1,121bn. Net new money was USD 26.2bn (USD 21.9bn excluding money market flows).

Investment Bank (IB) PBT USD 412m, (42%) YoY

The IB’s results included a USD 774m loss related to a default by a US-based client of our prime brokerage business. Global Markets revenue decreased by 27% or USD 554m, driven by the aforementioned loss. Excluding this loss, Global Markets would have been up 11%, driven by higher revenues from equity derivatives and cash equities products in a constructive market environment. Global Banking was up 48% or USD 254m, with a significant increase in Equity Capital Markets, driven by elevated IPO activity, and a significant increase in Advisory in EMEA. Credit loss releases were USD 2m. The cost/income ratio was 82.0%, 14.3 percentage points higher YoY, as income decreased by 12%, driven by the aforementioned loss, and operating expenses increased by 7%, largely driven by higher personnel expenses, mainly reflecting increased headcount and foreign currency translation effects. Annualized return on attributed equity was 12.7%.

Group Functions PBT USD (139)m, compared with USD (410)m in 1Q20

Extending UBS’s leadership in sustainable finance

Sustainable finance has been a firm-wide priority for UBS for years. The pandemic is sharpening the market’s understanding of the importance of climate transition and certain social issues, such as investment risks. UBS’s aim is to continue to help private and institutional clients meet their investment objectives through sustainable finance, making it a critical component of UBS’s strategy.

UBS has recently announced tougher environmental standards and will develop a detailed road map for achieving net zero greenhouse gas emissions across all its operations as a founding member of the Net-Zero Banking Alliance, bringing together 43 banks from 23 countries with over USD 28trn in assets, which are committed to aligning their lending and investment portfolios with net-zero emissions by 2050.

Details of the latest announcement outlining the firm’s sustainability ambitions can be found here.

UBS has also received the Gold Class Sustainability Award in the S&P Global Sustainability Yearbook showcasing the best performing companies in terms of environmental, social and governance metrics. In addition, the firm launched the first exchange-traded fund from its Asset Management’s Climate Aware range of sustainable investment products. The UBS Climate Aware Global Developed Equity UCITS ETF, listed across multiple European exchanges, provides exposure to large- and mid-cap stocks across developed markets.

Information in this news release is presented for UBS Group AG on a consolidated basis unless otherwise specified. Financial information for UBS AG (consolidated) does not differ materially from UBS Group AG (consolidated) and a comparison between UBS Group AG (consolidated) and UBS AG (consolidated) is provided at the end of this news release.

| 1 Return on CET1 capital is calculated as annualized net profit attributable to shareholders divided by average common equity tier 1 capital. 2 New performance measure for our Global Wealth Management business: Beginning with the first quarter of 2021, we introduced net new fee-generating assets as a new performance measure for our Global Wealth Management business. The new measure captures the growth in clients’ invested assets from net flows related to mandates, investment funds with recurring fees, hedge funds and private markets investments, combined with dividend and interest payments into mandates, less fees paid to UBS by clients. The underlying assets and products generate most of Global Wealth Management’s recurring net fee income and a portion of its transaction-based income. Compared with net new money, net new fee-generating assets exclude flows related to assets that primarily generate revenues when traded in the form of commissions and transaction spreads, or borrowed against in the form of net interest income, and also exclude deposit flows that generate net interest income, and custody positions that generate custody fees. We will no longer report net new money for Global Wealth Management in our quarterly reports, but will continue to disclose this measure in our annual reports. |

| Selected financial information of our business divisions and Group Functions1 | ||||||||||||

|

|

| For the quarter ended 31.3.21 | ||||||||||

| USD million |

| Global | Personal & | Asset | Investment | Group | Total | |||||

| Operating income |

| 4,848 | 1,037 | 637 | 2,273 | (90) | 8,705 | |||||

|

|

|

|

|

|

|

|

| |||||

| Operating expenses |

| 3,439 | 647 | 410 | 1,862 | 49 | 6,407 | |||||

|

|

|

|

|

|

|

|

| |||||

| Operating profit / (loss) before tax |

| 1,409 | 389 | 227 | 412 | (139) | 2,298 | |||||

|

|

|

|

|

|

|

|

| |||||

|

|

| For the quarter ended 31.3.20 | ||||||||||

| USD million |

| Global | Personal & | Asset | Investment | Group | Total | |||||

| Operating income |

| 4,547 | 904 | 514 | 2,449 | (480) | 7,934 | |||||

|

|

|

|

|

|

|

|

| |||||

| Operating expenses |

| 3,329 | 570 | 357 | 1,741 | (71) | 5,926 | |||||

| of which: net restructuring expenses |

| 61 | 1 | 5 | 19 | 0 | 86 | |||||

|

|

|

|

|

|

|

|

| |||||

| Operating profit / (loss) before tax |

| 1,218 | 334 | 157 | 709 | (410) | 2,008 | |||||

| 1 The “of which” components of operating income and operating expenses disclosed in this table are items that are not recurring or necessarily representative of the underlying business performance for the reporting period specified. |

| Our key figures |

|

|

|

| ||

|

|

| As of or for the quarter ended | ||||

| USD million, except where indicated |

| 31.3.21 | 31.12.20 | 31.3.20 | ||

| Group results |

|

|

|

| ||

| Operating income |

| 8,705 | 8,117 | 7,934 | ||

| Operating expenses |

| 6,407 | 6,132 | 5,926 | ||

| Operating profit / (loss) before tax |

| 2,298 | 1,985 | 2,008 | ||

| Net profit / (loss) attributable to shareholders |

| 1,824 | 1,636 | 1,595 | ||

| Diluted earnings per share (USD)1 |

| 0.49 | 0.44 | 0.43 | ||

| Profitability and growth2 |

|

|

|

| ||

| Return on equity (%) |

| 12.4 | 11.0 | 11.4 | ||

| Return on tangible equity (%) |

| 14.0 | 12.4 | 12.8 | ||

| Return on common equity tier 1 capital (%) |

| 18.2 | 16.8 | 17.7 | ||

| Return on risk-weighted assets, gross (%) |

| 12.0 | 11.4 | 12.0 | ||

| Return on leverage ratio denominator, gross (%)3 |

| 3.3 | 3.2 | 3.5 | ||

| Cost / income ratio (%) |

| 73.8 | 74.9 | 72.3 | ||

| Effective tax rate (%) |

| 20.5 | 17.2 | 20.4 | ||

| Net profit growth (%) |

| 14.3 | 126.7 | 39.8 | ||

| Resources2 |

|

|

|

| ||

| Total assets |

| 1,107,712 | 1,125,765 | 1,098,110 | ||

| Equity attributable to shareholders |

| 58,026 | 59,445 | 57,917 | ||

| Common equity tier 1 capital4 |

| 40,426 | 39,890 | 36,659 | ||

| Risk-weighted assets4 |

| 287,828 | 289,101 | 286,256 | ||

| Common equity tier 1 capital ratio (%)4 |

| 14.0 | 13.8 | 12.8 | ||

| Going concern capital ratio (%)4 |

| 19.6 | 19.4 | 18.1 | ||

| Total loss-absorbing capacity ratio (%)4 |

| 35.0 | 35.2 | 32.7 | ||

| Leverage ratio denominator3,4 |

| 1,038,225 | 1,037,150 | 955,943 | ||

| Common equity tier 1 leverage ratio (%)3,4 |

| 3.89 | 3.85 | 3.83 | ||

| Going concern leverage ratio (%)3,4 |

| 5.4 | 5.4 | 5.4 | ||

| Total loss-absorbing capacity leverage ratio (%)4 |

| 9.7 | 9.8 | 9.8 | ||

| Liquidity coverage ratio (%)5 |

| 151 | 152 | 139 | ||

| Other |

|

|

|

| ||

| Invested assets (USD billion)6 |

| 4,306 | 4,187 | 3,236 | ||

| Personnel (full-time equivalents) |

| 71,779 | 71,551 | 69,437 | ||

| Market capitalization1 |

| 54,536 | 50,013 | 33,649 | ||

| Total book value per share (USD)1 |

| 16.47 | 16.74 | 16.16 | ||

| Total book value per share (CHF)1 |

| 15.57 | 14.82 | 15.57 | ||

| Tangible book value per share (USD)1 |

| 14.65 | 14.91 | 14.37 | ||

| Tangible book value per share (CHF)1 |

| 13.85 | 13.21 | 13.85 | ||

| 1 Refer to the “Share information and earnings per share” section of the UBS Group first quarter 2021 report for more information. 2 Refer to the “Performance targets and capital guidance” section of our Annual Report 2020 for more information about our performance targets. 3 Leverage ratio denominators and leverage ratios for the respective periods in 2020 do not reflect the effects of the temporary exemption that applied from 25 March 2020 until 1 January 2021 and was granted by FINMA in connection with COVID-19. Refer to the “Regulatory and legal developments” section of our Annual Report 2020 for more information. 4 Based on the Swiss systemically relevant bank framework as of 1 January 2020. Refer to the “Capital management” section of the UBS Group first quarter 2021 report for more information. 5 Refer to the “Liquidity and funding management” section of the UBS Group first quarter 2021 report for more information. 6 Consists of invested assets for Global Wealth Management, Asset Management and Personal & Corporate Banking. Refer to “Note 32 Invested assets and net new money” in the “Consolidated financial statements” section of our Annual Report 2020 for more information. |

| Income statement |

|

|

|

|

|

|

| |||

|

|

| For the quarter ended |

| % change from | ||||||

| USD million |

| 31.3.21 | 31.12.20 | 31.3.20 |

| 4Q20 | 1Q20 | |||

| Net interest income |

| 1,613 | 1,622 | 1,330 |

| (1) | 21 | |||

| Other net income from financial instruments measured at fair value through profit or loss |

| 1,309 | 1,453 | 1,807 |

| (10) | (28) | |||

| Credit loss (expense) / release |

| 28 | (66) | (268) |

|

|

| |||

| Fee and commission income |

| 6,169 | 5,543 | 5,477 |

| 11 | 13 | |||

| Fee and commission expense |

| (478) | (459) | (456) |

| 4 | 5 | |||

| Net fee and commission income |

| 5,691 | 5,084 | 5,021 |

| 12 | 13 | |||

| Other income |

| 64 | 24 | 43 |

| 161 | 46 | |||

| Total operating income |

| 8,705 | 8,117 | 7,934 |

| 7 | 10 | |||

| Personnel expenses |

| 4,801 | 3,989 | 4,321 |

| 20 | 11 | |||

| General and administrative expenses |

| 1,089 | 1,515 | 1,133 |

| (28) | (4) | |||

| Depreciation and impairment of property, equipment and software |

| 508 | 617 | 456 |

| (18) | 12 | |||

| Amortization and impairment of goodwill and intangible assets |

| 8 | 10 | 16 |

| (16) | (46) | |||

| Total operating expenses |

| 6,407 | 6,132 | 5,926 |

| 4 | 8 | |||

| Operating profit / (loss) before tax |

| 2,298 | 1,985 | 2,008 |

| 16 | 14 | |||

| Tax expense / (benefit) |

| 471 | 341 | 410 |

| 38 | 15 | |||

| Net profit / (loss) |

| 1,827 | 1,645 | 1,598 |

| 11 | 14 | |||

| Net profit / (loss) attributable to non-controlling interests |

| 3 | 9 | 3 |

| (65) | 7 | |||

| Net profit / (loss) attributable to shareholders |

| 1,824 | 1,636 | 1,595 |

| 11 | 14 | |||

|

|

|

|

|

|

|

|

| |||

| Comprehensive income |

|

|

|

|

|

|

| |||

| Total comprehensive income |

| (339) | 1,728 | 4,195 |

|

|

| |||

| Total comprehensive income attributable to non-controlling interests |

| (9) | 27 | (2) |

|

| 426 | |||

| Total comprehensive income attributable to shareholders |

| (330) | 1,701 | 4,197 |

|

| ||||

| Comparison between UBS Group AG consolidated and UBS AG consolidated |

|

|

| |||||||||

|

| As of or for the quarter ended 31.3.21 | As of or for the quarter ended 31.12.20 | ||||||||||

| USD million, except where indicated | UBS Group AG consolidated | UBS AG consolidated | Difference (absolute) | UBS Group AG consolidated | UBS AG consolidated | Difference (absolute) | ||||||

|

|

|

|

|

|

|

| ||||||

| Income statement |

|

|

|

|

|

| ||||||

| Operating income | 8,705 | 8,836 | (130) | 8,117 | 8,220 | (103) | ||||||

| Operating expenses | 6,407 | 6,684 | (277) | 6,132 | 6,324 | (192) | ||||||

| Operating profit / (loss) before tax | 2,298 | 2,151 | 147 | 1,985 | 1,896 | 89 | ||||||

| of which: Global Wealth Management | 1,409 | 1,391 | 18 | 864 | 855 | 9 | ||||||

| of which: Personal & Corporate Banking | 389 | 390 | 0 | 353 | 353 | (1) | ||||||

| of which: Asset Management | 227 | 227 | 0 | 401 | 401 | 0 | ||||||

| of which: Investment Bank | 412 | 394 | 17 | 529 | 528 | 1 | ||||||

| of which: Group Functions | (139) | (251) | 112 | (161) | (241) | 79 | ||||||

| Net profit / (loss) | 1,827 | 1,713 | 114 | 1,645 | 1,572 | 73 | ||||||

| of which: net profit / (loss) attributable to shareholders | 1,824 | 1,710 | 114 | 1,636 | 1,563 | 73 | ||||||

| of which: net profit / (loss) attributable to non-controlling interests | 3 | 3 | 0 | 9 | 9 | 0 | ||||||

|

|

|

|

|

|

|

| ||||||

| Statement of comprehensive income |

|

|

|

|

|

| ||||||

| Other comprehensive income | (2,166) | (2,032) | (135) | 83 | 54 | 29 | ||||||

| of which: attributable to shareholders | (2,154) | (2,019) | (135) | 65 | 36 | 29 | ||||||

| of which: attributable to non-controlling interests | (12) | (12) | 0 | 18 | 18 | 0 | ||||||

| Total comprehensive income | (339) | (319) | (21) | 1,728 | 1,626 | 102 | ||||||

| of which: attributable to shareholders | (330) | (309) | (21) | 1,701 | 1,599 | 102 | ||||||

| of which: attributable to non-controlling interests | (9) | (9) | 0 | 27 | 27 | 0 | ||||||

|

|

|

|

|

|

|

| ||||||

| Balance sheet |

|

|

|

|

|

| ||||||

| Total assets | 1,107,712 | 1,109,234 | (1,522) | 1,125,765 | 1,125,327 | 438 | ||||||

| Total liabilities | 1,049,379 | 1,051,481 | (2,102) | 1,066,000 | 1,067,254 | (1,254) | ||||||

| Total equity | 58,333 | 57,753 | 580 | 59,765 | 58,073 | 1,691 | ||||||

| of which: equity attributable to shareholders | 58,026 | 57,446 | 580 | 59,445 | 57,754 | 1,691 | ||||||

| of which: equity attributable to non-controlling interests | 307 | 307 | 0 | 319 | 319 | 0 | ||||||

|

|

|

|

|

|

|

| ||||||

| Capital information |

|

|

|

|

|

| ||||||

| Common equity tier 1 capital | 40,426 | 38,826 | 1,600 | 39,890 | 38,181 | 1,709 | ||||||

| Going concern capital | 56,288 | 53,255 | 3,033 | 56,178 | 52,610 | 3,567 | ||||||

| Risk-weighted assets | 287,828 | 285,119 | 2,710 | 289,101 | 286,743 | 2,358 | ||||||

| Common equity tier 1 capital ratio (%) | 14.0 | 13.6 | 0.4 | 13.8 | 13.3 | 0.5 | ||||||

| Going concern capital ratio (%) | 19.6 | 18.7 | 0.9 | 19.4 | 18.3 | 1.1 | ||||||

| Total loss-absorbing capacity ratio (%) | 35.0 | 34.2 | 0.7 | 35.2 | 34.2 | 1.0 | ||||||

| Leverage ratio denominator1 | 1,038,225 | 1,039,736 | (1,511) | 1,037,150 | 1,036,771 | 379 | ||||||

| Common equity tier 1 leverage ratio (%)1 | 3.89 | 3.73 | 0.16 | 3.85 | 3.68 | 0.16 | ||||||

| Going concern leverage ratio (%)1 | 5.4 | 5.1 | 0.3 | 5.4 | 5.1 | 0.3 | ||||||

| Total loss-absorbing capacity leverage ratio (%) | 9.7 | 9.4 | 0.3 | 9.8 | 9.5 | 0.3 | ||||||

| 1 Leverage ratio denominators and leverage ratios for 31 December 2020 do not reflect the effects of the temporary exemption that applied from 25 March 2020 until 1 January 2021 and was granted by FINMA in connection with COVID-19. Refer to the “Regulatory and legal developments” section of our Annual Report 2020 for more information. |

Information about results materials and the earnings call

UBS’s first quarter 2021 report, news release and slide presentation are available from 06:45 CEST on Tuesday, 27 April 2021, at ubs.com/quarterlyreporting.

UBS will hold a presentation of its first quarter 2021 results on Tuesday, 27 April 2021. The results will be presented by Ralph Hamers (Group Chief Executive Officer), Kirt Gardner (Group Chief Financial Officer), Martin Osinga (Investor Relations), and Marsha Askins (Head Communications & Branding).

Time

09:00–11:00 CEST

08:00–10:00 BST

03:00–05:00 US EDT

Audio webcast

The presentation for analysts can be followed live on ubs.com/quarterlyreporting with a simultaneous slide show.

Contacts

UBS Group AG and UBS AG

Investors

Switzerland: +41 44 234 41 00

Americas: +1 212 882 57 34

Media

Switzerland: +41 44 234 85 00

UK: +44 207 567 47 14

Americas: +1 212 882 58 58

APAC: +852 297 1 82 00