Report: Michigan gets ‘D’ grade for fiscal health

(The Center Square) – A financial watchdog ranked Michigan 35th in the nation and stamped a “D” grade on the state for its current fiscal health.

The Financial State of the States report from the nonprofit government watchdog Truth In Accounting (TIA) found that every Michigan taxpayer would need to pay $16,800 to get the state out of debt.

That’s based on the state’s 2020 audited Comprehensive Annual Financial Report, which is the latest available data. Michigan advanced by four spots from the prior year’s ranking.

Fourteen other state governments joined Michigan with a near-failing “D” grade for a taxpayer burden between $5,000 and $20,000, determined by calculating the state’s debt divided by the number of taxpayers.

In total, the report found Michigan had $34.2 billion available to pay $87 billion worth of bills – leaving a $52.8 billion shortfall to pay its bills – a cost for which taxpayers will reap no services or benefits.

Michigan’s financial problems stem mostly from unfunded retirement obligations that have accumulated over a long period. The state had only set aside 60 cents for every dollar of promised pension benefits and 47 cents for every dollar of promised retiree health care benefits.

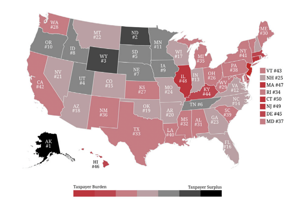

At the end of fiscal year 2020, 39 states did not have enough money to pay all of their bills. The total debt of the 50 states amounted to $1.5 trillion, according to TIA.

Only 11 states had a taxpayer surplus pre-pandemic.

“The majority of states were financially unprepared for any crisis.” TIA CEO Sheila Weinberg said in a statement. “When states can’t pay their bills, taxpayers are on the hook.”

The top three indebted states were:

Connecticut: per taxpayer burden of $62,500New Jersey: per taxpayer burden of $58,300Illinois: per taxpayer burden of $57,000

The average taxpayer burden across the 50 states was $9,300 for fiscal year 2020, $2,000 worse than the prior year.

The most fiscally healthy states were:

Alaska: per taxpayer surplus of $55,100North Dakota: per taxpayer surplus of $39,200Wyoming: per taxpayer surplus of $19,500

Nationwide, most state debt stems from unfunded retirement benefit promises, such as pension and retiree health care liabilities. For 2020, pension debt totaled $926.3 billion, and other post-employment benefits, mainly retiree health care, totaled $638.7 billion.

Disclaimer: This content is distributed by The Center Square