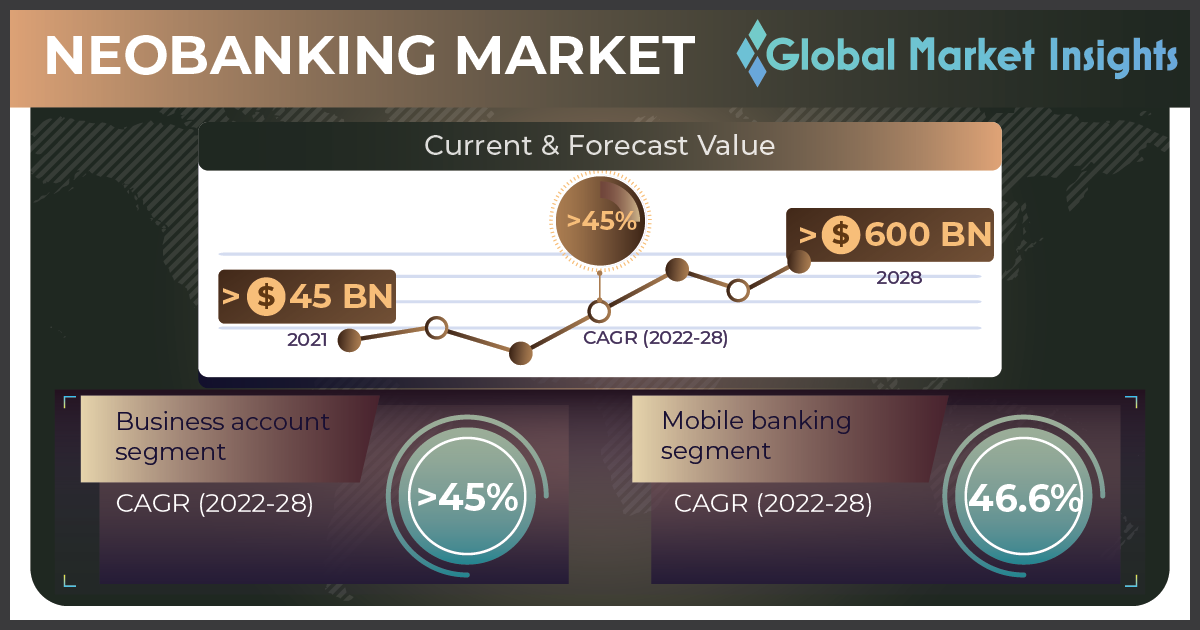

Neobanking Market to hit US$ 600 billion by 2028, Says Global Market Insights Inc.

The neobanking market from business account segment is set to expand at above 45% growth rate through 2028 impelled by the increasing demand for reduced complexities in managing banking processes of enterprise clients.

Selbyville, Delaware, March 10, 2022 (GLOBE NEWSWIRE) —

The neobanking market is anticipated to exceed USD 600 billion by 2028, as reported in a research study by Global Market Insights Inc. The extensive adoption of mobile banking platforms and fully digital banking experience are anticipated to contribute significantly to the market growth.

The rising demand for the comfort of customers in the banking industry is anticipated to boost the market growth. Neobanks are customer-centric and provide customized services to customers, which make them different from conventional banks. Neobank platforms help users to validate their service offerings in real-time with the help of mobile sites and online channels. Neobanks reduce the CAPEX & OPEX associated with the banking processes by embracing digital technologies, which are passed on as benefits to the customer.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/2844

The business account segment in the neobanking market is expected to grow at over 45% CAGR through 2028. The segment growth is attributed to the increasing demand for reduced complexities in managing banking processes of enterprise clients. Neobanking services help businesses to minimize the complications in managing transactions and cash payments across other partner banks. Moreover, they provide improved liquidity management capabilities along with control and convenience in major banking processes.

The checking/savings account segment is poised to witness a substantial market share by 2028. Neobank platforms have unveiled and improved their own products to compete with the incumbent traditional bank industry. For instance, Capital One 360, provides a no-fee checking account with similar advantages such as no minimum balance requirements. There are also Marcus by Goldman Sachs and Discover Bank from Discover Financial Services, among others, which are offering free of cost checking accounts, accelerating the segment growth.

The personal application segment is likely to observe considerable growth during 2022 to 2028. The massive penetration rate of smartphones has facilitated customers to extensively choose neobanking services due to convenience and ease of use. The services are provided utilizing mobile app interfaces, which assist money transfers and payments with the help of the app. The comfort of opening and operating accounts efficiently is further expected to boost the adoption of neobanking over the forecast timespan.

North America is projected to grow exponentially in the global neobanking market till 2028. The growth is credited to changing customer preferences, growing adoption of advanced technologies, and increasing digitalization across the fintech sector. Neobanking is becoming one of the most popular payment methods in North America due to its easy to use and advanced features. Incumbent banks have also stepped in to launch their own neobanking solutions such as Marcus by Goldman Sachs and Finn by JP Morgan Chase.

Neobanks have been largely relying on partnerships and teaming up with third-party companies to bring various products and customer solutions to market as quickly as possible. These partnerships are helping neobanks save time and money and be able to react to changing customer demands in a more flexible way. For instance, in January 2022, Neobank XTM signed a partnership agreement with Visa that helped in launching a debit card for XTM’s Today program, which helps hospitality and personal care consumers get access to earned wages and gratuities.

Some major findings of the neobanking market report include:

- Neobanking platforms have extensively differentiated themselves from the traditional banking models by offering automated products.

- The growing usage of advanced technologies, including AI, ML, cloud computing, etc., across the fintech sector is anticipated to support the market growth.

- The North America neobanking market is propelled by changing consumer preferences toward reducing physical branch visits, accelerated by COVID-19 pandemic.

- Major players operating in the neobanking market are Atom Bank Plc, Chime Financial, Inc., Monzo Bank Ltd., N26 GmbH, Nubank S.A., and Revolut Ltd., among others.

- The companies operating in the market are extensively adopting new & advanced technologies for providing reliable and secure neobanking solutions.

Request for customization of this research report at https://www.gminsights.com/roc/2844

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Neobanking industry 360º synopsis, 2018 – 2028

2.2 Business trends

2.3 Regional trends

2.4 Account type trends

2.5 Service trends

2.6 Application trends

Chapter 3 Neobanking Industry Insights

3.1 Introduction

3.2 Impact of COVID-19 outbreak

3.3 Evolution of neobanking

3.4 Neobanking industry ecosystem analysis

3.5 Investment portfolio

3.6 Patent analysis

3.7 Technology & innovation landscape

3.8 Regulatory landscape

3.9 Industry impact forces

3.9.1 Growth drivers

3.9.1.1 Integration of AI & blockchain technology into banking

3.9.1.2 Changing consumer behavior towards traditional banking methods

3.9.1.3 Growing demand of digitalization among the banking institutes

3.9.1.4 Rising investment in Fintech

3.9.1.5 Increasing adoption of electronic and mobile payment solutions

3.9.2 Industry pitfalls & challenges

3.9.2.1 Lack of clear regulatory framework

3.9.2.2 Rising cybersecurity issues

3.10 Growth potential analysis

3.11 Porter’s analysis

3.12 PESTLE analysis

About Global Market Insights

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

CONTACT: Contact Us: Arun Hegde Corporate Sales, USA Global Market Insights Inc. Phone: 1-302-846-7766 Toll Free: 1-888-689-0688 Email: [email protected]

Disclaimer: This content is distributed by The GlobeNewswire

Disclaimer: This content is distributed by The GlobeNewswire