Mahindra Dealers Ranked First in 2024 Compact Tractor Industry Study Measuring Response to Website Customers

- Room to Improve: 4 out of 10 compact tractor customers industrywide failed to receive a personal response to their online inquiry

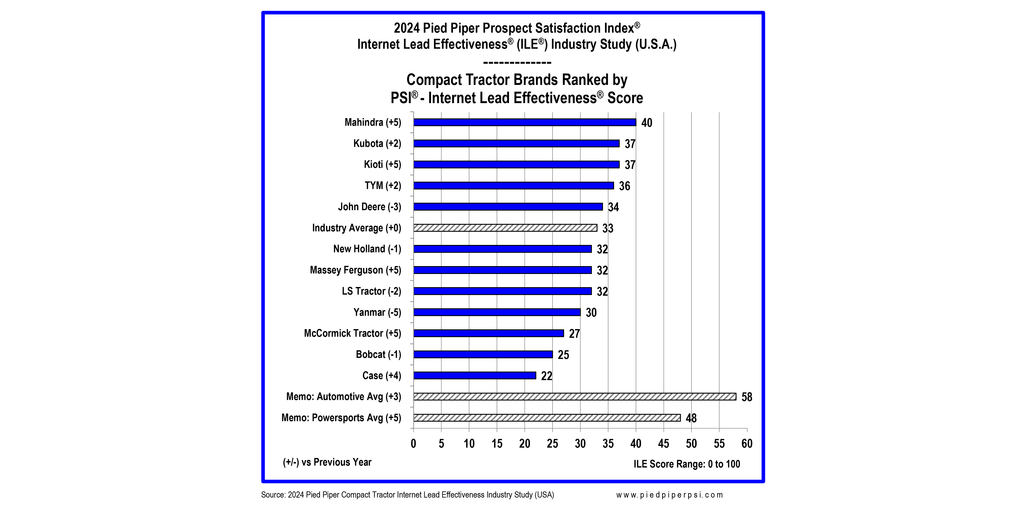

MONTEREY, Calif.–(BUSINESS WIRE)–Mahindra dealerships ranked highest in the 2024 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Compact Tractor Industry Study, which measured responsiveness to internet leads coming through dealership websites. Following Mahindra were dealers selling Kubota, Kioti, TYM and John Deere.

Pied Piper submitted customer inquiries through the individual websites of 607 dealerships representing all major compact tractor brands in the USA, asking a specific question about a tractor in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone, and text message over the next 24 hours. ILE evaluation of a dealership combines over 20 different measurements to create a total score ranging between zero and 100.

Overall responsiveness industry-wide has plenty of room for improvement. On average, 41% of customers received no personal response by email, text, or phone call when they inquired online about buying a compact tractor. “Improvement is very much worth it,” said Fran O’Hagan, Pied Piper CEO. “Dealers who respond quickly, personally, and completely to website customer inquiries on average sell 50% more units to customers who contact online as opposed to dealers who fail to respond.”

Compact tractor industry average ILE performance was unchanged compared to last year, with an average score of 33. Each brand’s industry study ILE score is an average that includes top-performing dealers as well as poor performers. In a traditional bell curve of performance, 5% of all compact tractor dealerships industrywide scored above 80 (providing a quick and thorough personal response), while 56% of dealerships scored below 40 (failing to personally respond to their website customers).

Mahindra, this year’s top-ranked brand, improved five points over the previous year to achieve the highest ILE score to date for an ag brand. Compared to last year, Mahindra dealers improved most of the behaviors measured by ILE. For example, Mahindra dealers were twice as likely this year to answer a customer’s question within 60 minutes, and twice as likely to respond to the same customer via multiple communication channels. Mahindra dealers also failed to respond in any way less often than dealers for any other brand, 11% of the time on average compared to the industry average of 18% of the time.

John Deere dealers were ranked first in the previous year’s ILE study, with a score of 37, but dropped to fifth in 2024, with a score of 34. John Deere dealers were much more likely to use texting to communicate with customers this year, 29% of the time on average, vs 12% of the time in 2023. However, only 16% of John Deere customers on average received an answer to their question by text message, and dealer replies using email or phone call declined from 2023 to 2024.

Response to customer web inquiries varied by brand, as shown by these examples:

- How often did the brand’s dealerships email or text an answer to a website customer’s question?

- More than 60% of the time on average: Kioti, TYM

- Less than 40% of the time on average: McCormick, Bobcat, Case

- How often did the brand’s dealerships respond by phone to a website customer’s inquiry?

- More than 30% of the time on average: Kubota, Case

- Less than 20% of the time on average: TYM, LS Tractor, McCormick

- “Did at least one” – How often did the brand’s dealerships email or text an answer to a website customer’s question and/or respond by phone?

- More than 65% of the time on average: Kioti, Kubota, TYM, John Deere

- Less than 40% of the time on average: Bobcat, McCormick

- “Did both” – How often did the brand’s dealerships email or text an answer to a website customer’s question and also respond by phone?

- More than 15% of the time on average: Kubota, Kioti, Massey Ferguson

- Less than 10% of the time on average: Yanmar, Bobcat, McCormick

- How often did a website customer fail to receive a response of any type (email, text, or phone call)?

- Less than 15% of the time on average: Mahindra, Kioti, Kubota

- More than 20% of the time on average: Massey Ferguson, LS Tractor, McCormick, Case

“Website customers today drive a dealership’s overall sales success,” said O’Hagan, “but website customers are invisible which makes them easy to overlook in day-to-day operations.” Pied Piper has found that the key to driving improvement in website response and sales is showing dealers what their website customers are really experiencing – which is often a surprise.

Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Studies have been conducted annually for various industries since 2011. The 2024 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Compact Tractor Industry Study was conducted between September and December 2023 by submitting personal website inquiries directly to a sample of 607 dealerships nationwide representing all major brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands improve the omnichannel sales & service performance of their retailers, by establishing fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2023 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Automotive Study (Cadillac ranked first), and the 2023 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Motorcycle/UTV Industry Study (Indian was ranked first) and 2023 Pied Piper STE® Service Telephone Effectiveness® (STE®) Motorcycle/UTV Industry Study (Harley-Davidson ranked first). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

Contacts

Pied Piper:

Ryan Scott

(831) 648-1075

[email protected]