ROB (Maharashtra and Goa) and PIB (Western Region) jointly organizes a webinar on ‘Faceless E-Assessment: Honouring the Honest’

The faceless E-Assessment system will bring about a paradigm shift by eliminating human interface in income tax assessment, will help to build trust within industry and wealth-creators: Chairman, CII-Goa. E-Assessment System based on algorithms and data-analytics and has no human element, cases of international taxation and those requiring searches and surveys kept outside purview of the scheme: Joint Commissioner, Income Tax, Bengaluru

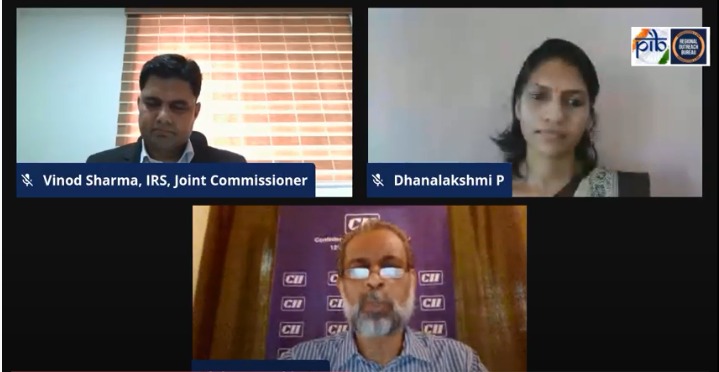

“A scheme where assessment would be done without the taxpayer knowing who is doing the assessing officer and there would be no human interface” is how Joint Commissioner, Income Tax in Bengaluru, Dr. Vinod Sharma defines the new ‘Faceless E-Assessment: Honoring the Honest’ scheme of the Union Government. Hailing it as “a game changer in the arena of direct taxes”, Shri Blaise Costabir, Chairman, Confederation of Indian Industries (CII)-Goa, stated, the new system will ensure uniformity of approach and uniform application of law-making and will put an end to the possible harassment of honest tax-payers. Both of them were speaking in a webinar on “Faceless E-Assessment: Honoring the Honest” organized by Regional Outreach Bureau (Maharashtra and Goa Region) and Press Information Bureau (Western Region) under the Union Ministry of Information & Broadcasting, today.

Speaking in the webinar, Mr Costabir said “Tax reforms for both the direct and indirect taxes have been one of the key focus areas for the Union Government for the past few years. The shift has been towards rationalization, simplification, greater transparency, ease of paying taxes and creating an overall tax payer friendly eco system. The faceless E-Assessment system will bring about a paradigm shift by eliminating human interface in income tax assessment. In a sense, it is a randomized and automated system based on the concept of dynamic jurisdiction. It eliminates the undesirable practices that emerge when there is a scope for individual discretion and subjective judgement. The anonymous nature of the process will discourage high-pitched assessments and will lead to objective, fair and just assessment orders which can be finalized quicker.” He further added, technology intervention in the faceless e-assessment system will also help to build trust within industry and wealth-creators. It has come at an appropriate time when the digital nature of Income Tax ensures continuity during the COVID-19 pandemic. “Now there will be no manual scrutiny, it will be only computer aided. There will be a focus on knowing the law, on skill, rather than knowing the officer or the networking ability of a particular tax consultant”, stated the Chairman of CII-Goa.

Explaining in details about the broad features of the faceless e-assessment system, Dr. Sharma said, since its launch on a pilot basis in October 2019, when around 58,000 cases and 25 Principal Commissioner-IT posts were notified under this scheme, around 15-16% cases have been completed without any hassles till now, despite the pandemic. “This is the beauty of the scheme. Even if there is any hurdle, work can still be done and obtain results”, he stated.

This scheme brings about three big reforms for the Income Tax Department: 1) Faceless Assessment 2) Faceless Appeal and 3) Taxpayers’ Charter. Speaking on it, Dr. Sharma informed, in the earlier scheme, an assessment officer had jurisdiction over a defined number of cases in a defined territory and was responsible for all kind of works related to those assessments, be it processing, scrutiny, assessment etc and also, in the post-assessment period, tasks related to recovery, filing appeal, sending remark reports etc; thereby overburdening the officer which in turn compromised the quality of the assessment. The very objective of doing assessment is to increase voluntary compliance or make a strong deterrent so that the tax payers disclose their true income while filing the ITR. Therefore, this new scheme was launched to decrease the burden and bring transparency, efficiency and accountability in the system. In this scheme, the core work of assessment has been taken away from the charge of a particular assessing officer. Now instead of any one individual involved in this work, a team would be involved in income-tax assessment. Now, there is an National E-Assessment Centre (NEAC) in Delhi, which works as a nodal office to communicate with the taxpayers. Now, taxpayers can communicate with this one office and similarly, the various departmental units like assessments unit, verification unit, technical unit etc would also be communicating with the NEAC. Therefore, there would be complete anonymity for the taxpayers as well as the department as to which unit is doing what work with regards to the various steps of assessment of a tax payer. Now, officials posted for faceless assessment will have only work to do now, that is, assessment. They will work in teams for different specialised functions like assessment, verification, technical inputs etc. The cases will be randomly allocated to various assessment units now. The NEAC has a Risk Management System (RMS) based on certain parameters and pre-defined algorithms. The cases would be distributed on the basis of a computer assisted system. After assessment, the cases will have to be passed through the RMS and then further course of action would be taken on basis of whether the case is selected for review or not. In case, some modification is suggested in the assessment of a particular case, then NEAC will re-assign it to a new assessment unit. This is a new addition and was not there earlier in the pilot project. Thus, this takes away individual and team level discretions completely just to avoid any kind of bias. This system is completely based on algorithms and data-analytics and has no human interface.

Mr Costabair flagged some concerns with the new scheme such as: training and awareness is required as this is a new scheme and there is going to be an issue of state based Court or Tribunal cases. In addition to this multiple languages in the country may make it difficult, as a tax filer may file in one language which has to be understood for an assessment in some other part of the country. In reply to these issues, the Joint Commissioner said, “Department and the NEAS is looking into these issues”. Mr. Costabir also mentioned, “Complete confidentiality may not be possible, for instance, land record document has to be submitted and then, name will come up”. Adding to it, he said, “But trust is being built and we have to build on that. During implementation of GST, Government had shown willingness to tweak the system and address issues that were being raised and can be expected to take a similar approach this time too”.

In reply to a query, the Joint Commissioner also mentioned that, two kind of cases have not been kept under the jurisdiction of this scheme, which are international taxation and those cases which require the IT Department to carry out searches. Further stating that still a lot of nitty-gritties are being worked out, the Joint Commissioner invited for suggestions from stakeholders so that these can be considered by the Income Tax Department before finalizing the SOPs.

The welcome address has been delivered by Shri D.V. Vinod Kumar, Deputy Director -PIB Goa. He made a beginning remark that this scheme is expected to rule out personal interactions and undesirable practices. The webinar has been moderated by Smt Dhanalakshmi P., Information Assistant in PIB Mumbai.

Click here for the link to the webinar