New Massachusetts flood insurance rates more fair, flood insurance expert say

(The Center Square) – Massachusetts homeowners with flood insurance saw their rates change as the Federal Emergency Management Agency (FEMA) re-evaluated national flood insurance rates that were decades old.

Joe Rossi, chair of the Massachusetts Coastal Coalition and president of the Joe Flood Insurance Brokerage, said the changes reflect the recognition that the National Flood Insurance Program’s (NFIP) rating methodology was archaic.

“What I like to put it as is, imagine a Fortune 500 company that has never changed its methodologies and pricing for 52 years,” he told The Center Square. “That company would definitely not be in business anymore.”

Rossi said not only did the old rating system not consider a lot of risk factors, but it also wasn’t fair. He notes the new rating system, or Rating System 2.0, has been dubbed by FEMA as “equity in action.”

NFIP was established in 1968 to offer flood insurance to homeowners who chose to live in high-risk areas where insurance was either unavailable or too expensive, as reported by WBUR.

For Massachusetts homeowners, FEMA estimates 39% will see immediate decreases, while 49% will see an average increase of $0-$10 per month. The final two categories are 6% respectively, and those will see an average increase of $10-$20 per month and then $20 or greater.

“What we’re seeing though is that those greater increases are in areas where either there’s high-value buildings or commercial structures, which again would probably be considered more high value,” Rossi said.

In action, Rossi said what is happening is following FEMA’s estimates pretty closely.

“There are, of course, those seeing projected increases and those that are seeing decreases, but overall the breakdown is that about 40% will see an immediate decrease in their premium and about 50% will see a small or no increase,” he said. “Just to keep that in perspective, if we had not changed from Risk Rating 1.0 to 2.0, every April 1, 100% of rates were going up in price.”

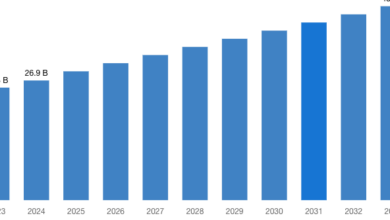

Over the past 10 years, private flood insurers have entered the market, notes Rossi. He thinks this new rating system may push some to explore the private flood insurance market.

“That market is growing quite rapidly,” he said. “So there may be those that go to the private market to look for policies if they are either building or buying a home in a place where the federal government policy is too expensive.”

Disclaimer: This content is distributed by The Center Square