John Deere Compact Tractor Dealers Ranked First for Responding to Website Customers, Industry Survey Shows

- 57% of compact tractor website customers industrywide received no personal reply to their inquiry

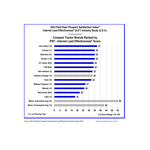

MONTEREY, Calif.–(BUSINESS WIRE)–John Deere dealerships ranked highest in the 2023 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Compact Tractor Industry Study, which measured responsiveness to Internet leads coming through dealership websites – behaviors tied directly to retail sales success. Dealers selling Kubota, Mahindra and Yanmar tied for second, followed by LS Tractor and TYM, which were included in the study for the first time.

“Quick response to web customers is critical to selling, placing an order, or building the foundation for future sales,” said Fran O’Hagan, CEO of Pied Piper. “Dealers who respond quickly, personally, and completely to website customer inquiries on average sell 50% more units to their web customers as opposed to dealers who fail to respond.”

Overall responsiveness industrywide to compact tractor website customer inquiries has plenty of room for improvement. “On average, 57% of customers received no personal response when they inquired online about buying a compact tractor,” said O’Hagan.

Pied Piper submitted customer inquiries through the individual websites of 614 dealerships, asking a specific question about a tractor in inventory, and providing a customer name, email address and local telephone number. Pied Piper then evaluated how the dealerships responded by email, telephone, and text message over the next 24 hours. ILE evaluation of a dealership aggregates 20 different measurements to create a total score, between zero and 100.

Compact tractor industry average ILE performance increased four points from last year, for an average score of 33, while John Deere, this year’s top-ranked brand, improved six points to 37. Compared to ag dealers, auto and powersports dealers today are much more likely to quickly respond to website customers. The most recent auto industry average ILE score was 55, while the powersports industry average ILE score was 43. However, the performance of auto dealers fifteen years ago, and of powersports dealers five years ago, was similar to that of the ag dealers today. For example, Harley-Davidson dealers achieved an average ILE score of 31 in 2018, compared to a score of 60 in 2022.

To be clear, each brand’s industry study ILE score is an average, including top-performing dealers as well as poor performers. In a traditional bell curve of performance, 8% of all compact tractor dealerships industrywide scored above 70 (providing a quick and thorough personal response), while 53% of dealerships scored below 30 (failing to personally respond to their website customers).

Compared to last year, compact tractor dealerships were more likely to personally respond to their website customers. Dealers sent an email answer to a website customer’s inquiry 43% of the time (39% last year), responded by phone 21% of the time (13% last year), and responded by text message 5% of the time (2% last year). However, one in four of all dealerships contacted failed to respond in any way to the study’s website customer inquiries. In an era when shoppers now largely use the Internet to initiate first contact with a dealer, a non-response is equivalent to a lost sale.

Response to customer web inquiries varied by brand and dealership, as shown by these examples:

- How often did the brand’s dealerships email or text an answer to a website customer’s question within 60 minutes?

- More than 30% of the time on average: John Deere, LS Tractor

- Less than 15% of the time on average: Case, McCormick, Bobcat, Mahindra

- How often did the brand’s dealerships respond by phone to a website customer’s inquiry?

- More than 25% of the time on average: Kubota, LS Tractor, John Deere

- Less than 15% of the time on average: McCormick, Case, Yanmar, TYM

- How often did the brand’s dealerships send a text message to their website customer?

- More than 10% of the time on average: John Deere, LS Tractor

- Less than 3% of the time on average: McCormick, Case, Kioti

“Most dealers today accept that website customers are critical to sales success, but because website customers are invisible, too often they end up ignored,” said O’Hagan. Pied Piper has found that the key to driving improvement in website response and sales is showing dealers what their website customers are really experiencing – which is often a surprise.

Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Studies have been conducted annually for various industries since 2011. The 2023 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Compact Tractor Industry Study was conducted between September 2022 and January 2023 by submitting website inquiries directly to a sample of 614 dealerships nationwide representing all major brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California, company that helps brands improve the omnichannel sales & service performance of their retailers, by establishing fact-based best practices, then measuring and reporting performance. Examples of other recent Pied Piper PSI studies are the 2022 Pied Piper Prospect Satisfaction Index® (PSI®) Premium Auto Study which measured the omnichannel sales experience of premium auto shoppers (General Motors’ Cadillac brand was ranked first), and the 2022 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Motorcycle/UTV Industry Study (Harley-Davidson was ranked first). Complete Pied Piper PSI industry study results are provided to vehicle manufacturers and national dealer groups. Manufacturers, national dealer groups and individual dealerships also order PSI evaluations – in-person, internet or telephone – as tools to measure and improve the omnichannel sales and service effectiveness of their dealerships. For more information about the Pied Piper Prospect Satisfaction Index, and the fact-based PSI process, go to www.piedpiperpsi.com.

Contacts

Ryan Scott

[email protected]

+1 (831) 648-1075