ClearScore is excited to announce an exclusive partnership with Driva to provide users with personalised and pre-approved* car financing options.

Accessible through ClearScore’s free Confidence feature, Australian users can feel more confident and empowered when searching for car loans with Driva.

This is a significant milestone in our journey to help everyday Australians access credit pain-free. By partnering with Driva we’ve been able to leverage their loan matching algorithm and provide our users with pre-approvals for car loans without them needing to leave our platform” said Lloyd Smith, General Manager of ClearScore Australia.

With over 30 lenders and innovative technology that provides users with personalised car loan offers within 60 seconds, Driva and ClearScore are revolutionising how we finance our cars.

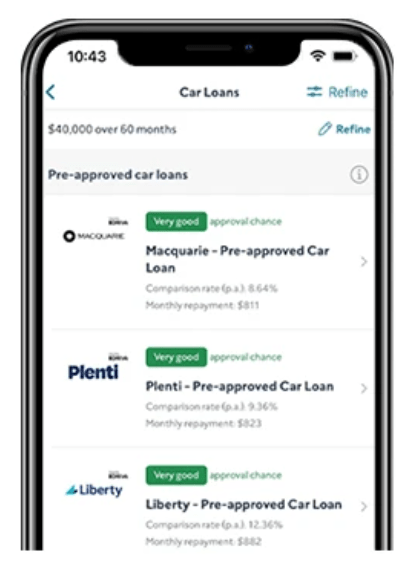

ClearScore users can access Driva’s personalised car loan rates on their offers panel after adding information regarding their desired borrowing amount, contract length, car manufacturer and employment status.

This ground-breaking technology can help consumers see their pre-approved car loan rate, while protecting their credit scores by avoiding excessive enquiries.

After finding the perfect loan offer with the best rate, Driva will assess the users’ application to indicate the likelihood of approval on ClearScore’s dashboard, before they apply.

“Driva has thousands of lender data points built into its proprietary loan matching algorithm, which has been made accessible to ClearScore with their new Driva integration. This enables them to give consumers rate confidence after considering key personal factors like credit score, living situation and employment status” said William Brown, Co-Founder of Driva.

As Australia is becoming an increasingly digitised society, the car financing market has failed to provide consumers with quick and easy access to transparent loan options.

Furthermore, when considering that loan repayments are statistically the highest cost of car ownership, with AUD$35.7 billion capitalised from car finances in 2017, ClearScore and Driva expect that this partnership will disrupt the market by providing more power to consumers.

“The vehicle loan space is huge in Australia, but has historically been neglected by previous incumbents who have placed more emphasis on products like Mortgages and Credit Cards. With this partnership, we think ClearScore will be leading the way in helping Australian consumers compare their options in the complicated world of car financing” said William Brown.

With over 90% of car sales involving financing, this partnership will have an extensive reach in the Australian market, helping consumers take more control over their finances and is the first of its kind in the Australian comparison industry.