Audible Magic Sponsors MIDiA Research Report on The Rising Power of User-Generated Content

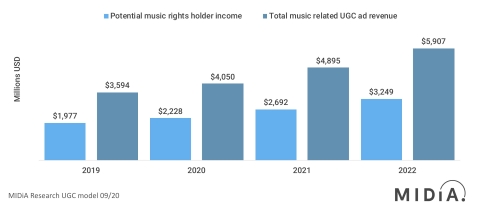

UGC is the next music industry growth driver and the short-term opportunity is worth $6 billion

Music-related UGC is a fast-growing and under-commercialised sector with huge future potential. Potential UGC music-related revenues, 2018 – 2022, global (Graphic: Business Wire)

London, United Kingdom & Los Gatos, Calif., United States:

User-generated content will contribute a significant proportion of the growth in music consumption over the next two years in an opportunity that is worth circa $6 billion to the music industry value chain. Rights holders could see $3.2 billion of this in the next two years, as a new report by MIDiA Research in partnership with Audible Magic, has found—with UGC already having contributed over one billion dollars to global music revenues in 2019.

‘The Rising Power of UGC’ report, which is available to download for free here, examines the dramatic and continuing growth of UGC creation and consumption and highlights that this ongoing expansion requires the implementation of new, simpler licensing frameworks, especially for music.

This report also considers some of the implications of the 2019 EU Copyright Directive, which acknowledges the importance of UGC in today’s economy and presents unique opportunities to encourage the growth of the digital streaming market.

The rising power of UGC is reflected by the sharp growth in social media platforms in 2020, totalling 7.7 billion gross users. Lil Nas X’s Old Town Road, as one example, set a new course for music industry marketers by becoming the first clear example of the ‘song as a hashtag’ – turning a song from a TikTok meme into a global smash hit. More than two billion streams later, almost every marketer in the industry is hoping to repeat the song’s success – though not necessarily with a clear blueprint as to how to do that.

Social media and UGC platforms do not respond to traditional licensing structures and as a result, opportunities are being missed. Framing these trends within the poor performance of ad-funded models, the slowing down of subscription revenues and the absence so far of alternative ways to monetise fandom, the report advocates new ways for the industry to approach UGC to become a win-win for technology platforms and content providers. Social media platform advertising revenue, meanwhile, totalled $119 billion in 2019 – a huge addressable market, while in-app purchases and virtual merch are emerging forms of monetisation.

Content owners might well ask “what’s next?” But what’s next is already here: social media is the new music consumption; it just isn’t being fully monetised or utilised.

Commenting on the implications of these shifts for content companies, a major label executive said: “It is important for music content owners to start imagining UGC as another format or channel for the delivery of music rather than simply as promotion or audience development.”

Mark Mulligan, MIDiA Research’s managing director said: “As music subscriptions edge towards maturity in many Western markets, the music industry needs new growth drivers. UGC has long been under-monetised for music rights holders but its potential now is bigger than ever.

“We are entering into an era where we are all becoming creators, whether that be editing digital photos, making a lip sync video or even creating a mashup. We are leaning forward and interacting with our content more and more, with more tools at our disposal. Music continues to be the soundtrack to both our lives and to UGC content. We sit on the cusp of the next chapter in music consumption and monetisation.”

Disclaimer: This content is distributed by Business Wire India.