A guide on how to better invest in the stock market Investing in the stock market is a great way to earn money and achieve your financial goals

However, there are a few things you need to keep in mind before investing. First of all, you need to be clear about what you want to invest in and why.

Secondly, do not get caught up in the hype; the fact that a stock is doing well does not mean that it is suitable for your portfolio or that other investments are not better right now.

Thirdly, use what you know and understand so as not to be misled by others who may have less knowledge than you.

Have clearly in mind what you want to invest in and why.

If you want to succeed in the stock market, it is important that you have a clear idea of what you want to achieve with your investment.

You should also have in mind the goal of how much money you want to earn for the investment to be considered a success and make sure that this goal is in line with your other financial priorities.

The reason it is so important to be clear about what you want is that you give yourself a direction and purpose when it comes time to trade or choose stocks.

Hopefully, this clarity will help prevent greed from getting out of control, which can easily happen if we are not careful; after all, our instincts have been honed by evolution into animals that instinctively seek sources of food and mates, not necessarily profits.

Don’t be greedy

Do not invest more than you can afford to invest. Carefully consider the many factors that go into a good investment decision, such as risk tolerance and time horizon.

You should also consider your financial goals and determine how much of your portfolio should be allocated to investments with higher potential returns compared to low-risk options that may generate a lower income but are less likely to cause a capital loss over time (e.g. stocks or bonds).

Understand the risks involved.

As an investor, you need to understand what the risks are and how they work to avoid making mistakes that could cause you to lose money.

It is important for investors of all kinds (beginners or experts) to be aware of the risks involved in investing.

The first thing you need as an investor is diversification; this means having multiple sources of income within your portfolio so that if one of them fails, the others can continue to go strong.

When choosing companies to include in your portfolio, look at their fundamentals, such as analyzing revenue growth trends over time, rather than focusing only on short-term results, as these can be misleading indicators of the overall health of success.

Invest in shares of solid companies

Investing in stocks of solid companies is a good way to start investing. A solid company is one that is financially stable, has strong leadership, and is profitable.

Cryptocurrencies: only invest in them if you know the topic

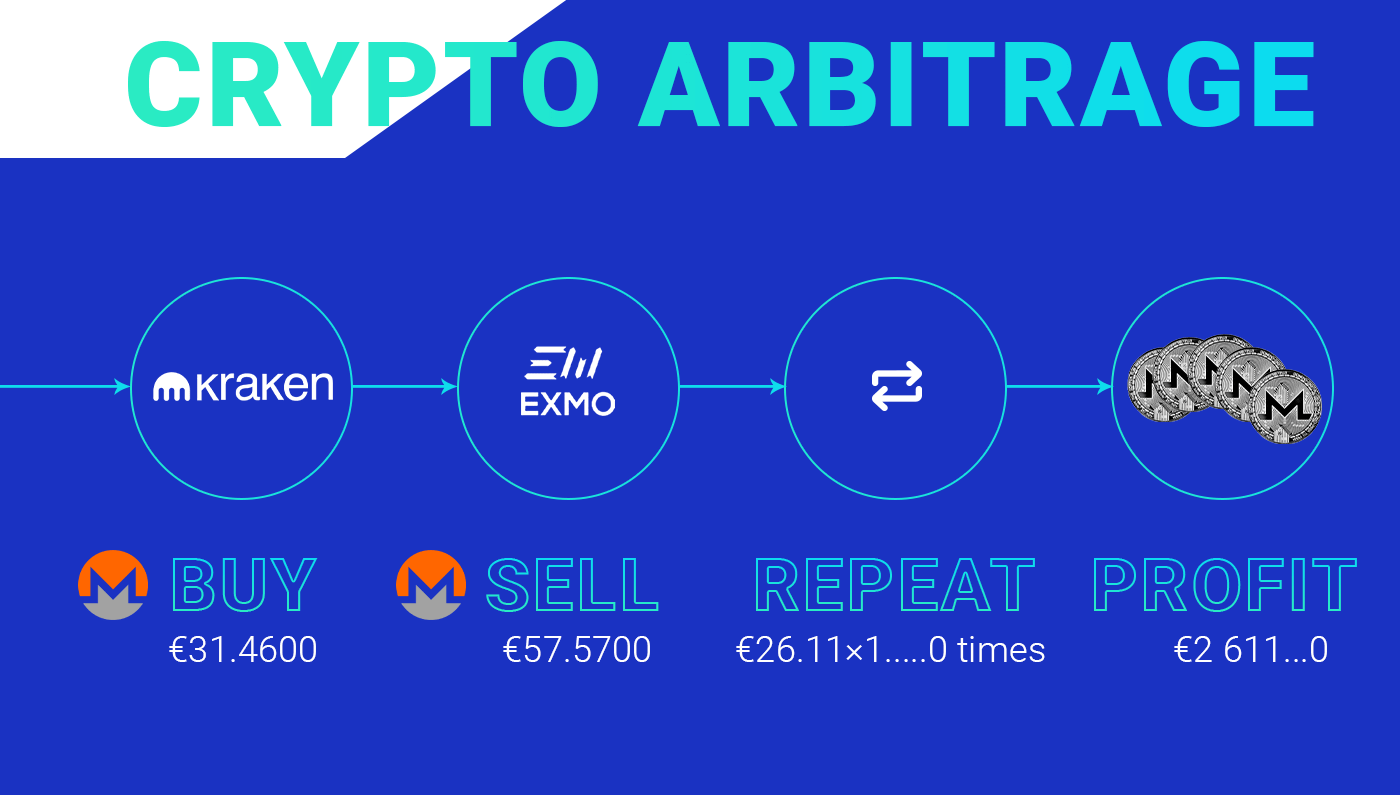

One of the most popular ways for investors to make money by trading cryptocurrencies is to buy them at a low price and later sell them at a profit.

This strategy can be profitable under certain circumstances, but it also carries an element of risk: if an investor buys too many coins at once without carefully assessing their value or their potential use as a currency, they could end up losing their entire investment due to unforeseen circumstances.