AGS Transact Technologies Aims to Issue 25 Lakh National Common Mobility Cards (NCMC) Over the Next Two Years

In a circular dated 23rd February 2024, the Reserve Bank of India (RBI) has permitted licensed bank and non-bank managed prepaid payment instruments (PPIs) to issue prepaid cards for use across various public transport systems, without the mandatory KYC verification. One of the prominent PPI offerings is the National Common Mobility Card (NCMC), an open-loop card that offers interoperability across different transport networks in India such as Metro.

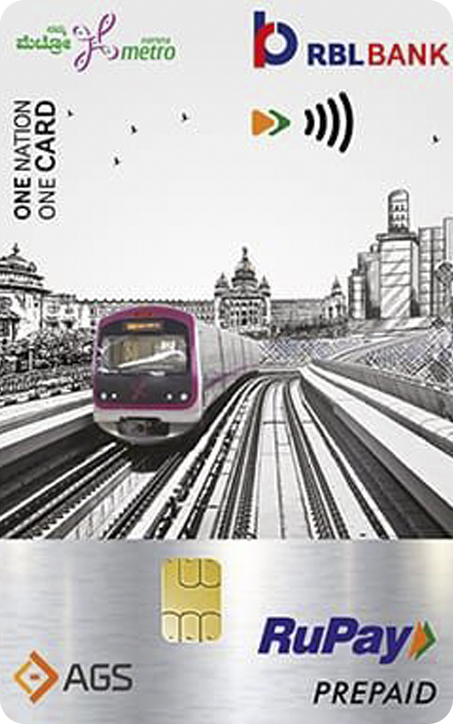

AGS Transact Technologies, one of the largest omnichannel integrated payments solutions provider in India, has partnered with RBL Bank to issue NCMC for Bangalore Metro Rail Corporation Limited. Following the recent announcement of RBI, the company expects an uptick in NCMC adoption to about 2 lakhs by June 2024, once the new process for issuance of NCMC is implemented, expectedly by mid-March. Overall, AGS Transact Technologies plans to issue around 25 lakh NCMCs over the next two years.

RBL Bank BMRCL NCMCs are secure and contactless open loop prepaid cards on Rupay platform that can be recharged easily through BMRCL RBL Bank NCMC app or a web portal and across BMRCL Metro stations and select RBL Bank branches. NCMCs are developed to work even in low network coverage areas, such as underground parking and metro stations. In addition to public transport payments, the cards can be used for fuel, bill payments, dining as well as retail & ecommerce platforms that accept RuPay payments.

Current Steps to apply for RBL Bank BMRCL NCMC powered by AGS Transact Technologies:

- Mobile App: Download “BMRCL RBL Bank NCMC” app on the Google Play Store or

Web Portal: Visit the web portal at https://nammametro.agsindia.com/

- Register on the app / web portal. A registration number will be generated upon successful OTP verification.

- Now visit the ticket counter at the nearest Bengaluru Metro Station or RBL Bank Branch and provide the registration number. Your NCMC will be activated, and a physical card will be given following OTP authentication. The card is now ready for transactions such as shopping, ecommerce and dining.

- You can top-up the NCMC via UPI, wallets, credit/debit card and internet banking or visit the nearest metro station.

- To avail transit services like metro, transfer the fund from your online wallet to offline wallet on your app or web portal.

- Tap your NCMC on self-service kiosk at BMRCL Metro station and enjoy the seamless commute experience.

About AGS Transact Technologies Limited (AGSTTL)

Established in 2002, AGS Transact Technologies Limited (BSE: 543451| NSE: AGSTRA) is one of the largest integrated omni-channel payment solutions providers in India in terms of providing digital and cash-based solutions to banks and corporate clients. AGS Transact provides customised products and services comprising ATM and CRM outsourcing, cash management and digital payment solutions including merchant solutions, transaction processing services and mobile wallets. The company operates in three broad business segments, namely, Payment Solutions; Banking Automation Solutions; and Other Automation Solutions.

AGS Transact Technologies serves diverse industries such as banking, retail, petroleum, toll and transit, cash management and fintech in India and other select countries in Asia. As of December 31, 2023, the company has deployed 2,48,126 payment terminals and was one of the largest deployers of PoS terminals at petroleum retail outlets in India, having rolled out 45,525 terminals at various petroleum retail outlets.